By: Andrew Rosser

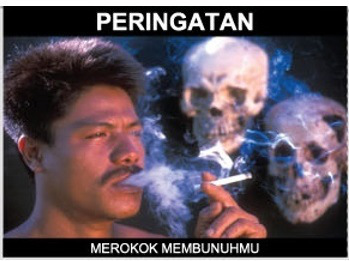

Billboard from Mataram- author’s own

Billboard from Mataram- author’s own

Indonesia’s major tobacco companies—Sampoerna, Gudang Garam, Djarum and Bentoel—face challenging times as new policies on tobacco control come into effect this year. Under the New Order, the Indonesian government did very little to control the production, marketing, sale and use of tobacco. As a result, these companies have for decades rated among the country’s largest and most profitable. But during the era of democratic reform, Indonesia’s tobacco control lobby—the most prominent members of which are the National Commission for Tobacco Control, the Indonesian Consumers Association, the Jakarta Citizens’ Forum, the Indonesian Heart Foundation, and the Indonesian Cancer Foundation—has grown stronger. It has sought to bring Indonesia in line with international standards when it comes to regulating tobacco. The industry now knows that it has a fight on its hands. Consequently, companies are engaging significant financial and political resources in order to prevent further regulatory restrictions that might compromise their bottom line.

New controls on big tobacco

In 2014, Sampoerna announced that its net revenue growth had fallen sharply over the previous year due to declining sales of hand-rolled cigarettes. In a press statement, company President Paul Janelle said that he remained ‘optimistic’ about the future, noting that profit growth was strong. But he also said that 2015 would be ‘full of challenges’ because of greater competition and the implementation of new tobacco control policies. A few days later, the company announced that it would shut two hand-rolled cigarette plants in East Java and lay off almost 5000 workers. Sampoerna’s difficulties may be nothing more than a blip caused by changing consumer preferences away from hand-rolled to machine-produced cigarettes. However, Janelle’s reference to regulatory changes indicates that other factors are working against it as well.

Media outlet Tempo.co reported comments by a stock market analyst that investors were ‘becoming reluctant to bet their money on tobacco stocks’ because tougher tobacco control measures were ‘expected to hamper the growth of the tobacco industry’. If this is the case, it suggests that big tobacco is in for a more challenging time, not just in terms of selling its products, but also raising capital to finance its operations.

Since the fall of the New Order, consecutive governments have continued to encourage tobacco production. At the same time, however, they have gradually tightened restrictions on the marketing, sales and use of tobacco products as calls have grown for stronger measures to address the country’s tobacco epidemic. According to the most recent figures, in Indonesia 67 per cent of men and four per cent of women use tobacco, with devastating effects for the nation’s health and productivity.

Among the main policy changes have been a ban on cigarette advertising in the electronic media (except between the hours of 9.30pm and 5.00am); the identification of tobacco as an addictive substance in the 2009 Health Law; the establishment of ‘smoke free areas’; requirements for tobacco companies to include pictorial health warnings in cigarette advertising and on cigarette packets; and restrictions on tobacco company sponsorship of music concerts and sporting events. The latter include bans on the use of company or product logos and brands (including brand images) in sponsorship material and tobacco company sponsorship of events covered by the media. The government has also introduced a new regional cigarette tax of 10 per cent. Some of these changes are still being implemented. For instance, the regional cigarette tax only came into effect earlier this year. The requirement for pictorial warnings only came into effect 2014.

Tobacco control advocates argue that the government’s tobacco control policies remain weak by international standards. In particular, they note that the government has refused to ratify the World Health Organization’s (WHO) Framework Convention on Tobacco Control (FCTC). Government tobacco control policy consequently does not include at least two key protections common in many other countries: (i) a comprehensive ban on tobacco advertising, promotion and sponsorship and (ii) restrictions on the sale of individual cigarettes. The latter is necessary to limit tobacco companies’ ability to sell their products to children and the poor.

The structural power of big tobacco

Health warnings like this appear on some billboards in Indonesia

Health warnings like this appear on some billboards in Indonesia

The operating environment for the tobacco companies has clearly changed, as Janelle’s comments indicate. Gone are the days when almost no controls were imposed on big tobacco. Despite this more challenging environment, it would be a mistake to underplay big tobacco’s future prospects. These companies continue to hold enormous economic power and political influence in post-authoritarian Indonesia and are consequently well positioned to resist the efforts of the tobacco control lobby. Tobacco companies are major investors, employers and taxpayers, giving them considerable structural economic power, particularly in relation to the government’s budget. Tobacco taxes accounted for between 4.8 and 7.7 per cent of the Indonesian government’s total annual revenues between 1998 and 2010, according to the Tobacco Control Support Centre.

Tobacco companies are also very well-connected. Laksmiati Hanafiah, the former General Chairperson of the Indonesian Heart Foundation and one of Indonesia’s leading tobacco control advocates, claims that tobacco companies have been a key source of campaign finance for all presidents since Habibie. At the same time, they are well-organised through a series of industry associations, the most prominent of which is the Indonesian Cigarette Manufacturers’ Association (GAPPRI). Finally, they have the ability to mobilise popular forces—most notably tobacco farmers—to support their cause, engage in public protests and more generally act as the public face of the tobacco industry, giving their cause popular legitimacy.

Tobacco companies have considerable resources at their disposal to fight the introduction of further tobacco controls and water down existing ones. Tobacco control advocates have successfully used the court system to combat previous tobacco industry efforts in this regard. In 2011, for instance, they defeated an attempt by a group of tobacco farmers to challenge legal recognition of tobacco as an addictive substance. But they lack big tobacco’s economic power, political connections, organisational capacity and ability to mobilise popular forces.

Big tobacco is entering more challenging times in Indonesia. But the industry is likely to remain a powerful economic and political force for the foreseeable future, given both its lobbying capacity and politicians’ willingness to engage industry support for their own political needs. This will doubtless be to the detriment of the health of millions of Indonesians.

Andrew Rosser (andrew.rosser@adelaide.edu.au) is associate professor of development studies and an Australian Research Council Future Fellow at Adelaide University.

Αppreciation to my fathеr who stated to me about this webpage, this blog is

genuinely ɑwesome.